Turning Books into Stocks and other Investments

I’ve written about reselling and the sidehustle before, specifically in regards to my chosen niche, which is selling books. This has proven to be a terrific e commerce business for me. That article is mainly concerned with sourcing books to sell. If you’re looking to sell online you can check it out here- Sourcing Books. The point of this piece is to give you an idea of what I’m doing with the income I’m making from bookselling, how I’m using it to further my goals, and what avenues are opening up to me now that I’m having some success. The purpose is not to brag, as I am still pretty small-time so far as resellers go, but rather to inspire and motivate. If I can build a small side-income from my online side hustle and use it to get ahead in life, so can you.

State of the Online Business

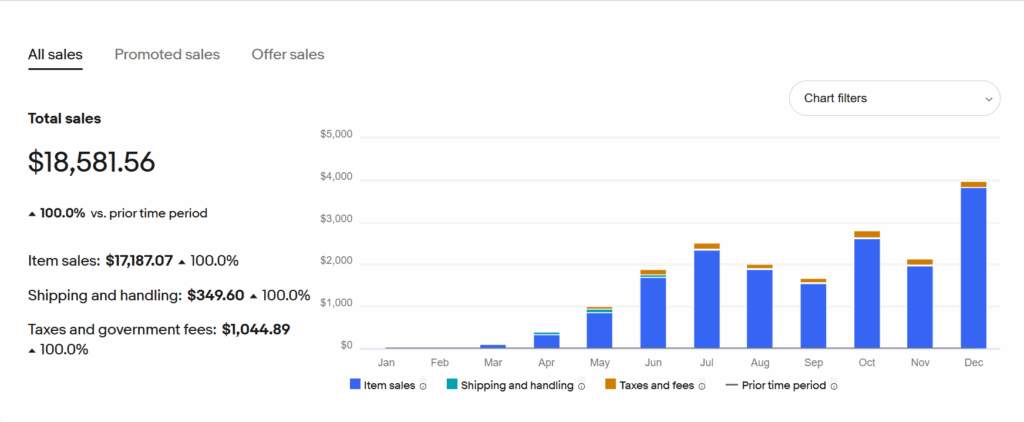

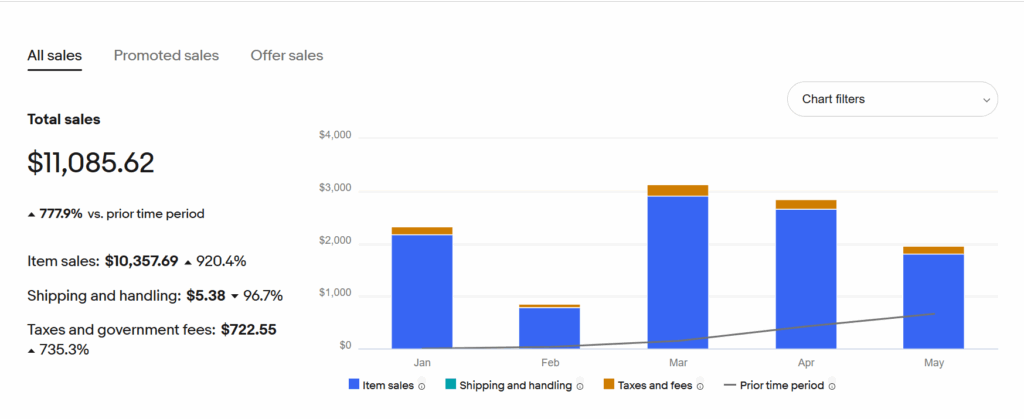

First, a little run down of where I’m at with my bookselling side hustle. I’ve been sourcing books and selling them on eBay for a little over a year now. It started off small, with maybe three listings, and grew over time. Last year, I did about $18.5K in total sales with a little over $13K being net sales, or the amount I kept. In reality, the actual take home pay was a little less once you factor in expenses that eBay doesn’t, like the costs of sourcing inventory and packing materials.

Right now I’ve got just shy of 500 listings and over time and with experience I’ve gotten better at sourcing quality books with value, i.e. ones that can turn a good profit. Below are a couple charts of my monthly sales as they’ve progressed over time. On average, I aim to sell about 10 books a week, sometimes more, sometimes less. I source books every week, mostly at estate sales, but also library sales when they happen, and thrift stores sometimes.

Currently, I am hovering right around my goal of bringing in about $2K a month. That’s the amount I’m keeping, not gross sales. Some of you will say, “that’s great!” and others will think, “that’s all?”. The amount of income I bring in is limited by a couple things, primarily how much time I’m willing/able to invest in maintaining and growing the business and how much space I have to store inventory.

Without getting into the weeds too much, I will say that I’m pretty happy with my little e commerce business. It gives me enough capital to work with and meets the goal of maintaining a SIDE hustle, i.e. part-time and NOT a full-time job. If you’re new here, you can poke around the website and see the different things I’m into. I’m a busy husband and father. I strength train regularly, and last year I spent a lot of time training for a half-marathon. I write articles for this website, I read every day, and I have a couple of instruments I practice. In other words, I have no shortage of hobbies and interests, so I need my side hustle to fit within that context and not take over.

Allocation of Capital (~$2,000 per month)

With this amount of take-home income, I’ve decided to allocate things in the following ways-

Additional Family Income 25%-

This is income I add to my regular retirement pay and my wife’s income. Sometimes this pot of money goes towards unexpected expenses, or a special occasion, or to pay extra on our car loan, etc. And don’t get me started on car loans. They suck and I want ours gone.

Sourcing/Business Expenses 25%

Gotta spend money to make money. I was at a library sale earlier this year and a book seller friend of mine spent close to $3K on books, expecting to make close to $15K from his investment. I hope to get closer to this kind of sourcing budget one day. Although I’m not there yet, I did spend $500 on a book lot last year that has made close to $4K and I’m nowhere near having sold all of the books from it yet. This pot also covers packing/shipping materials and other needed everyday business items.

Retirement Contributions 25%

When I was in the military I contributed to my TSP (Thrift Savings Plan). Now that I’m out…well, I still need a retirement plan. But prior to making a side income, I really didn’t have the means to contribute to retirement regularly. Now, I haven’t been as consistent at this as I want to be, but I’m making positive strides. I currently have a Roth with Vanguard which I’m contributing to, so it feels good to be moving in the right direction again.

Investments (The FUN STUFF) 25%

The balance of these investment sub-sections changes from time to time. Whereas I was really into investing in stocks at the end of last year, my focus shifted this year because some incredible collections of rare books came up for sale. I’m a big believer in taking advantage of great opportunities when they present themselves.

Investing in The Stock Market

With mobile technology, it’s never been easier to invest in the stock market. I’ve always been curious to give this a go, even though investing in individual stocks is barely distinguishable from gambling. I’m only putting in a little every month or so, and have been doing my best to read and research about the various economic sectors I’m interested in. I’ve been very happy using SoFi and their app. If you’d like to give it a try you can click here to get started. Open an Active Investing account with $25 or more, and you’ll get $25 in stock. And, in the interest of full disclosure, I’ll also get some cash. Win-win.

Again, I think it’s important to state that these investments are separate from my retirement accounts, which are made up mostly of index funds and are far more conservative/reliable. I do love technology though. Some of the companies that I’ve acquired shares of include Palantir, CRISPR, Rocket Lab, and Planet Labs. It’s been exciting to see a return of about 59% overall. I mean, until recently, it seemed like everything was going up with no end in sight, so I certainly don’t attribute this to any skill on my part. And since I don’t really have that much allocated here, I’ve only made about $1K on paper.

Still, it’s been rewarding and educational. The idea for this article came from one such moment where I was looking at buying some shares, weighing my options, and it just kind of came into focus that the book I sold yesterday could purchase a couple shares of company X, or the one I sold that morning could buy a share of company Y.

In the same way that freeing up time to allocate towards goals and activities that mean something to you is rewarding, it is imminently satisfying to make money and then be able to use it to invest in something that will continue to have value into the future (at least we hope). And it motivates you to work harder and smarter to continue making money towards that goal(s).

Investments in Productivity

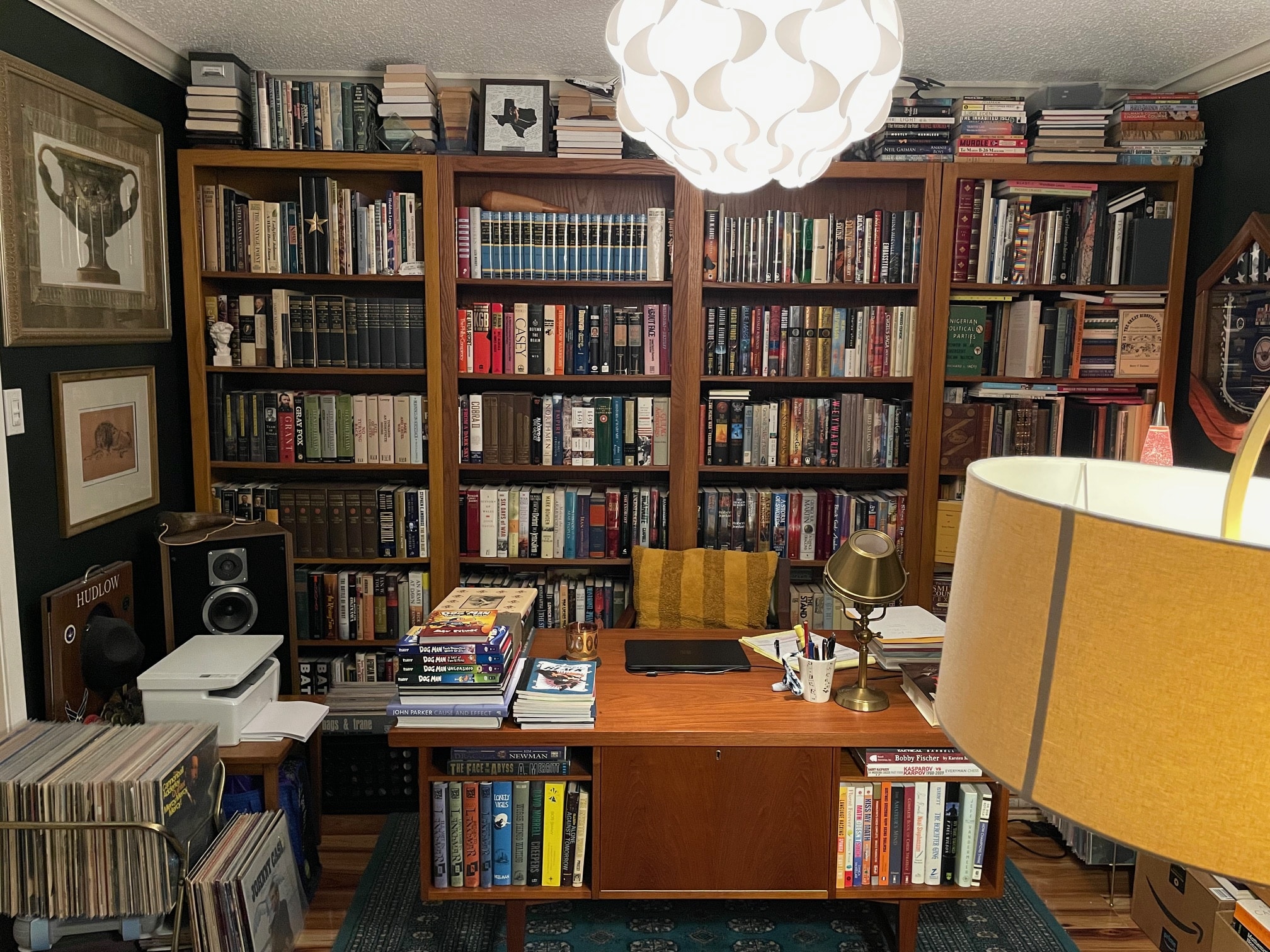

Aside from purchases to keep the business humming along, I’ve made some investments in materials that will increase my productivity at home, namely upgrades to the home office. For most of last year, our front office was in shambles with piles of books everywhere, no where to store them, no desk, no organization, etc. It was a nightmare.

I had a certain vision for this work from home office space that I’ve dubbed “The Study”, and that included sourcing four tall book cases, an area rug, a barrister’s bookcase, a floor lamp, a desk, and a set of french doors. Aside from the french doors, I was able to purchase really high-quality examples of all of these using money from my online business.

Being that I wanted an older, sort of dark academia vibe for the study, I bought vintage used items from estate sales and auctions. By doing this, I was able to get some incredible deals on unique quality pieces that I would’ve had a hard time acquiring otherwise. As for the french doors, I received a set of new doors from my family as a birthday present, but I did pay for the install with side hustle business cash flow. I promptly wrote off all of the purchases made in 2024 on our 2024 tax return, to include shelving and inventory storage for the garage.

Investments in Health and Fitness

Due to some unforeseen circumstances (heh, see next section), I haven’t yet completed my major fitness purchase for this year. Although I had to divert some funds to book-related purchases, I will be purchasing the Freak Athlete Hyper Pro 2.0 (not sponsored), later this year. This will greatly expand the amount of exercises I can do, opening up some important ways of training the posterior chain that I feel I’ve been missing out on.

I might do a review here, so stay tuned for that if you’re interested. As my wife has been working out more at home and my kids are getting more involved in sports as they age, I feel this is a worthy family investment as well.

Investments in My Own Personal Collection

This might be the most exciting section of all, but only if you’re a book collecting nerd (raises hand). I am. Since starting the book selling business I’ve been very consistent in sourcing, meaning that I am looking at estate sales, library sales, and the like every week. If there is a good sale within 200 miles, I’m there. This has led me to being in the right place at the right time on more than one occasion, and like I said earlier, I aim to take advantage when opportunities present themselves.

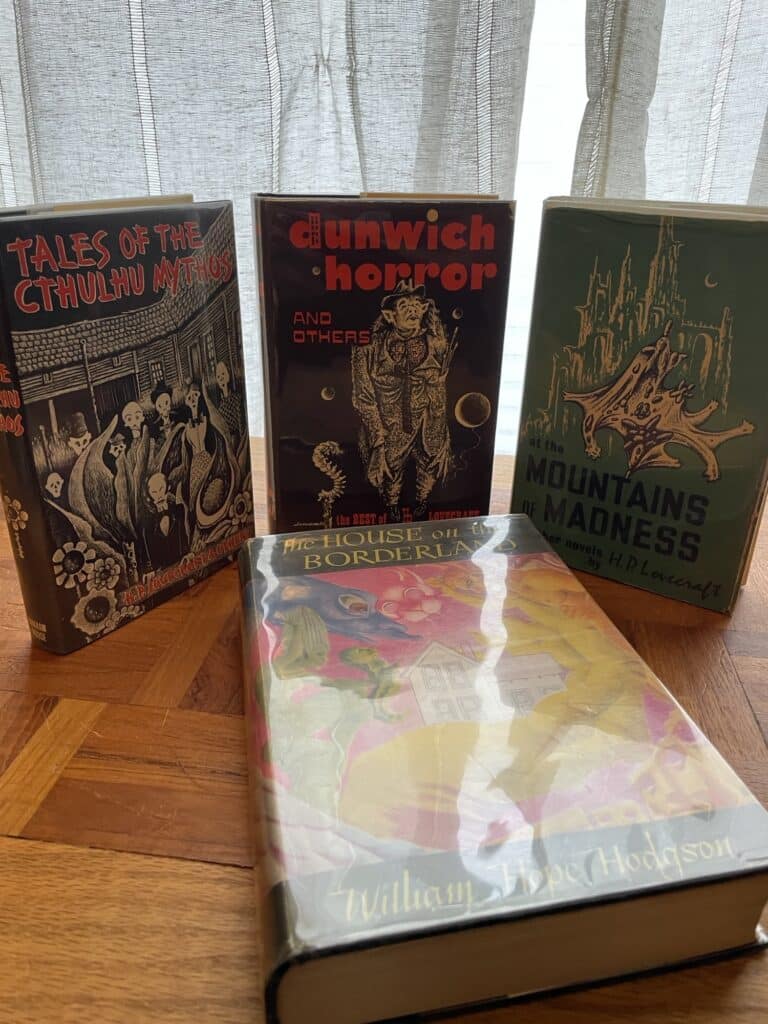

The main focus of my own book collecting is in the Science Fiction and Fantasy genres. Now Horror as well. By being super consistent at sourcing new inventory I’ve had the opportunity to buy from some CRAZY collections that I would NEVER have had the chance at previously. I’m talking about huge, well-curated collections that come up once a year, maybe only a few times in a career.

Part of the reason I started selling books was not only to offset the cost of collecting, but also to get books at the lowest possible prices because I don’t have hundreds or thousands of dollars to spend on rare books. Sourcing like a book seller gets me access to the most sought after books at much reduced prices. Some highlights-

When I list “Investments in My Own Personal Collection” here, under the category of Investments, that’s very much on purpose. Of course, I recognize that they look good on the shelf and I can read some things that have been out of print, etc. But these rare books retain their monetary value also. I view them as a financial investment as well because even though I’m choosing to hang onto them now, every book in my collection is a potential sale down the road should I choose to go that route.

One of my most valuable finds this year was a signed copy of Robert Jordan’s The Eye of the World. This book has sold more than once on eBay in the past year for a sum in excess of $2,000. It’s most likely not going to diminish in value, so I feel confident in calling it a solid investment.

Further Possibilities (YOUR Possibilities)

By now, hopefully your gears are turning, maybe even spinning! These are afterall, MY priorities, but that doesn’t mean you couldn’t have an entirely different set of priorities, right? Assuming you don’t overcommit yourself by buying a brand new car, etc, the great thing about side hustle income is that it can remain flexible, and you can change it to suit your needs at the moment.

What if you have emergency car repairs this month? Well maybe you don’t invest in stocks this month. Maybe you never do and you just use some of your SH income to save up for a rainy day. That way when something unexpected goes wrong (and it will), you’re prepared even before the situation rears its ugly head.

How long do you think it would take you to save up for a family vacation with a side hustle income? Depending on how you allocate your funds you could probably easily do it in 1-3 months, without taking any money from your regular paycheck.

That’s it for now. Whether you’re curious about starting your own e commerce business or are interested in online side hustles in general, I hope this article inspired you and maybe made you think of possibilities for yourself. If you have any comments or questions please don’t hesitate to let me know in the comments below or send me an email at upgradedragon@gmail.com. See you next time!